All property owners need to make sure that they have the right type and amount of insurance for their property. The notion of property insurance gets more complex for landlords, due to the wide variety of insurance policies needed to ensure sufficient coverage. Unfortunately, many landlords elect the cheapest coverage, choosing to pay the lowest premiums possible. Although this may seem like a smart short term decision to save money, what happens when there is a fire or a tenant injures themselves on site. Without the right types of insurance, or enough coverage, such events could be devastating for any property owner.

We’ve put together a short list of rental and tenant insurance policies that every landlord would be smart to consider.

Physical Assets:

This outlines how much coverage you have in case your physical assets are destroyed. This is listed on your policy declarations page. For example, if you have a 3,000 square foot house and it costs $100 per square foot to rebuild, you should have $300,000 in physical asset coverage. The insurance will only cover the structure, not the land. Landlords will also want to calculate the total value of all non-attached structures such as a garage or appliances and then add this to the required coverage amount.

Now, take the above example. If you had a tragic house fire that caused $200,000 in damage, yet you only had $100,000 in coverage, how much would you need to pay? The answer, you’d get $100,000 from the insurance agency, and then you’d be responsible for the other $100,000. As you can imagine, many landlords that opt for cheap plans with low coverage often get burned (no pun intended) in such situations.

Renter’s Insurance:

Landlords should also check and make sure that tenants have a Renter’s Insurance policy in place. This protects tenants from theft, fire and water damage, as well as liability. Another bonus of having renter’s insurance is that any related claims will go against their insurance first, not the landlord’s main policy. Renter’s policies are very affordable, typically ranging from $100-$150 per year.

General Liability Insurance:

This is third-party coverage. Essentially, it reimburses property owners if they have compensated another for their losses. General liability doesn’t cover intentional wrong doings such as arson, but it usually covers negligence and general liability issues. For example, if your tenant’s dog bites your next door neighbor’s child, you’re going to be sued first. If this happens, your liability insurance will pay for a lawyer to defend you in a legal dispute up till the coverage limit. Any additional expenses beyond the coverage limit comes out of the landlord’s pocket.

Another important point to consider is contractor liability insurance. In order to reduce general liability insurance premiums, landlords should require all repairman and outside contractors working on their rental properties to provide proof of adequate liability coverage and worker’s compensation. Even better, require each contractor to have at least one million dollars in liability insurance. Taking this step will ensure maximum protection against liability law suits.

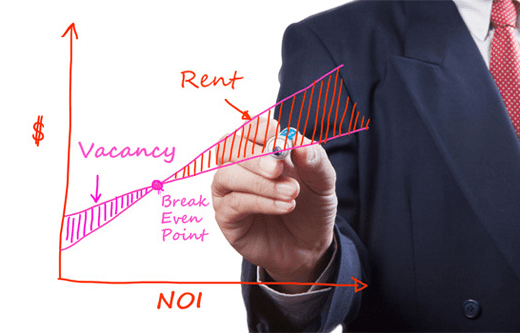

Loss of Income Clause:

This clause protects landlords if their property is damaged to the point where it is no longer fit to rent. As we all know, if there are no tenants renting a property, landlords are losing a ton of money. A loss of income clause will cover the income lost during such a period of vacancy up until the coverage limit, while the house is under repairs.

Umbrella Insurance:

Even with all of these different types of insurance, sometimes it isn’t enough. It’s wise for landlords to purchase Umbrella Insurance. This provides property owners with excess liability insurance coverage beyond the limits provided in a general liability policy. Landlords are able to increase their liability coverage in increments of $1,000,000 for $300-$500 per year depending on the provider. Calculate the net worth of you assets in order to make sure you have adequate coverage. If not, invest in an umbrella policy.

Conclusion:

Landlords need to sit down periodically (every year) and assess the type and amount of coverage they hold. Don’t fall into the trap of choosing policies with the lowest premiums, especially as your property portfolio expands. In fact, I’d recommend property owners invest in an adequate umbrella policy and take the necessary steps to ensure that all tenants and external contractors have a set amount of liability and renter’s insurance in place.

There are many other forms of insurance that are worthy of discussion in this article. What would you add here?